During the last couple months the Washington Post has been running a series of articles on financial fraud at non-profit organizations using the annual Form 990 report. According to their research, more than a thousand organizations have disclosed “a significant diversion” of assets (such as embezzlement) since 2008. “Significant” means it exceeds $250,000 or five percent of the organization’s assets or receipts, so minor occurrences of fraud are not revealed. Charitable organizations (such as museums and historic sites) were by far the most common victims, representing about 65 percent of the total. Educational institutions were the second most common victims, but fell far behind at about 15 percent.

During the last couple months the Washington Post has been running a series of articles on financial fraud at non-profit organizations using the annual Form 990 report. According to their research, more than a thousand organizations have disclosed “a significant diversion” of assets (such as embezzlement) since 2008. “Significant” means it exceeds $250,000 or five percent of the organization’s assets or receipts, so minor occurrences of fraud are not revealed. Charitable organizations (such as museums and historic sites) were by far the most common victims, representing about 65 percent of the total. Educational institutions were the second most common victims, but fell far behind at about 15 percent.

The three most common forms of financial fraud are:

- Investment schemes (such as investing with Bernie Madoff)

- Embezzlement (such as an employee stealing funds)

- Purchasing fraud (such as inappropriate expenses by a board member)

The Post also discovered that many organizations noted they had uncovered fraud, but failed to adequately explain the nature of the diversion, amounts or property involved, and any corrective actions taken. It’s this failure to disclose that’s attracting the attention of the IRS, Congress, and state regulators.

Among the museums, historical societies, and historic sites that experienced “diversions” since 2008 were:

- American Lighthouse Foundation (Maine)

- Cherokee Historical Association (North Carolina)

- Clinton County Historical Association (New York)

- Friends of the Railroad Museum (Pennsylvania)

- Historic Savannah Foundation (Georgia)

- Mark Twain House (Connecticut)

- Monterey History and Art Association (California)

- Peoria Historical Society (Illinois)

- Philadelphia Museum of Art Women’s Committee (Pennsylvania)

- Prairie Aviation Museum (Illinois)

- Studio Museum in Harlem (New York)

- Texas Highway Patrol Museum (Texas)

- Tippecanoe County Historical Association Foundation (Indiana)

- Virginia Association of Museums (Virginia)

- Winterthur Museum (Delaware)

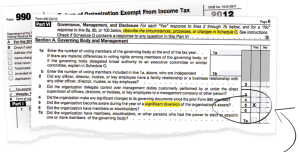

I’m not listing them to further embarrass these organizations, but to demonstrate that no non-profit is immune. It doesn’t just happen to the “little guys” or the “country folks.” It’s also a reminder that the Form 990 has changed dramatically in the last few years and discloses much more information, so if you serve on a board or work as an employee, you need to review the latest copy (they’re public information and should be easily available from the nonprofit; if not, try GuideStar.org). If you’re concerned about becoming a victim, read my earlier post, “Embezzlement: Is it Our Dirty Little Secret?”

For more details, the Washington Post ran the following stories recently:

- “Inside the Hidden World of Thefts, Scams, and Phantom Purchases at the Nation’s Nonprofits” (October 26, 2013) is the lead story with several case studies, highlighting the American Legacy Foundation.

- “The Most Intriguing Check Box on a Nonprofit’s Disclosure Form” (October 26, 2013) discusses the common reporting patterns and nonprofit types.

- “How the ‘Queen’ of High School Rowing Left a Virginia Nonprofit Treading Water” (October 26, 2013).

- “Millions Missing, Little Explanation” (October 26, 2013) provides a searchable database of nonprofits that have disclosed diversions, built in collaboration with GuideStar.

- “Something’s Rotten in the State of Nonprofits” (October 30, 2013) are three letters-to-the-editor in response to the initial stories.

- “Congress Promises Multiple Investigations of Possible Wrongdoing at Charities” (November 1, 2013) describe the efforts of federal and state officials to explore whether nonprofit groups properly reported losses to authorities.

- “Nonprofits Need Protections From Scoundrels” (November 11, 2013) is an editorial by the Washington Post.

- “Nonprofit Groups Often Seek Restitution, not Prosecution, When Money Goes Missing” (November 23, 2013) includes a case study of embezzlement by an executive director, who left after being caught but continued to work at other nonprofits.

- “Maryland Woman Accused of Stealing Millions from DC Nonprofit Group” (November 24, 2013) is a case study of an administrative assistant embezzling funds by creating fake invoices and whose fraud was discovered by the bank, not the nonprofit.

- “Lawmakers Press IRS Nominee on Reports of Charity Theft, Call for Greater Oversight” (December 12) notes that John Koskinen, President Obama’s nominee to head the Internal Revenue Service, would launch an inquiry into nonprofit organizations that have failed to disclose financial diversions.

Thank you for sharing this Max. This is just another illustration of the need for board members to ask tough questions and really scrutinize the financial reports they get at board meetings. Often the Board meeting agendas are so tightly packed and sometimes I think the agendas are set up that way to prevent board members from carefully reviewing and discussing financial issues. This has to change.

LikeLike

Alas, most boardmembers of nonprofit have little interest or experience in managing finances. They’re there because of the mission and money is an uncomfortable or inappropriate topic in non-profit organizations. The result is that scarce resources can be wasted and the mission left unfulfilled.

LikeLike

Max, the story at the Texas Highway Patrol Museum goes deeper than just a “diversion” – take a look at this: http://www.mysanantonio.com/news/local_news/article/Highway-patrol-museum-finished-3822323.php

LikeLike

Yikes! This is a diversion of about 99% of funds raised. Not sure why it took the Attorney General so long to put a stop to this (and how unaware the board was).

LikeLike